Chinese Purchases Of U.S. Real Estate Poised To Rise

Author: Russell Flannery is a senior editor and the Shanghai bureau chief of Forbes magazine. A fluent Mandarin Chinese speaker now in his 11th year at Forbes, Russell compiles the Forbes China Rich List, Hong Kong Rich List, and Taiwan Rich List. Russell was previously a correspondent for Bloomberg News in Taipei and Shanghai and for the Asian Wall Street Journal in Taipei. A Massachusetts native, he holds degrees from the University of Vermont and the University of Wisconsin at Madison.

4/10/2011 @ 7:55AM |

Growth in the number of well-off mainland Chinese, an increase in overseas study by their children, and a drop in U.S. property prices are leading to more purchases of U.S. real estate by buyers from China. Where are they buying and why? How can U.S. developers and other sellers connect with Chinese buyers?

To find out more, I talked to Steven Lawson, CEO of the Windham Realty Group of Michigan. He opened the company’s China headquarters in Shanghai in 2008 and has lived in the city since 2007. Excerpts follow.

Q. From a Chinese point of view, why is it a good time to buy U.S. property?

A. The U.S. represents a good value for what we consider to be a rapidly globalizing Chinese investor. Permanent private ownership and the market adjustment in the last five years represent a good time for people who are well funded with cash to take advantage of market conditions.

Q. What do you mean by good value? The market is still coming down on the whole, according to some news reports.

A. The U.S. on the whole does have some softness. In particular, Las Vegas, Detroit and Atlanta are really dragging down the market. But when you look at the two cities that our clients are most interested in – New York, particularly Manhattan, and the L.A. area, they are not behaving in the same way as the U.S. market. In L.A, properties are still in many cases 20% below their 2007 peak, and there is some room for capital appreciation.

Importantly, a lot of our clients have some level of self- use intention, whether it’s a business connection, a children’s education connection, or an immigration intention connection. In terms of the clients who’ve transacted, I think we would say 60% + have an education connection. Education is a huge driver. So Boston is a rather natural market for us to kind of dig into. It’s only more recently that we’re seeing more purely investment-driven clients.

Q. How long have you been doing business with Chinese customers, and how are you approaching this new business?

Page 2 of 4

A. We probably started thinking about China and investigating China a little later that we should have. It was in 2006. We started making trips to China in about 2006-2007. Now we have set up our infrastructure in China — an investment consulting business. In the U.S., we have a brokerage company. We’re able to work with our clients here (in China), and give them information. Then, we’re able to refer them to our U.S. company. It functions legally. In the U.S., we have two types of clients – self-use clients and about 20 developers spread out between New York, California, Florida and Michigan. Relative to our total business, China is still not proportionally big, but we anticipate that it’s still going to grow bigger and bigger.

Q. You mentioned that there is growing interest in investment in U.S. commercial properties among Chinese. How will that play out in the next few years?

A. I think it’s going to grow substantially, because the U.S. commercial market has some stress and difficulties, and it’s going to create opportunities. We are getting more inquiries from people who are interested in purchasing commercial property, primarily hotels, shopping centers and office buildings. One of the things we have done is to open a New York office. So we see a trend of emergence (of demand) on the commercial side.

Q. Who is a typical buyer?

A. We had a group in town this week, three to four people represented some typical Chinese diversified companies. They’re in the education field, they’re in the travel field and they’ve made other overseas investments but they’ve been more in Singapore and the UK. Now, they’re interested in acquiring U.S. property. I think the trend is moving in that direction.

Q. What’s a typical trip to the U.S. like when you have a group that is going over?

A. We arrive in New York, we show New York and New Jersey, and we go down to Florida. We show Miami and say, “Here’s a place where there isn’t a tremendous Chinese population but that we think one day there will be. Then we go to Vegas. That’s usually just to play, and then we do L.A. and San Francisco. This spring we’re going to alter that: we’re going to have Boston, too, because there’s just so much interest in education.

This year, we’re going to try to do a golf-related tour. We find a lot of clients have a lot of enthusiasm for golf, so we’ll (visit) some great golf courses and then enjoy looking at some golf real estate. You have to show some hospitality. You have to show you care before people develop some trust in you. We try to make it fun. We try to make it light. We have had transactions that have occurred as a result of a tour, but much more often it comes six months or a year later.

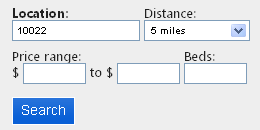

Q. How do you identify customers in China?

A. We have a website, and our web traffic is reasonably substantial. Of course we utilize search engine optimization and search engine positioning. The other thing we’ve done is to set up what we refer to as channel partners. They tend to be in the areas of immigration consulting, education consulting, financial consulting and real estate. These channel partners in essence send us clients, and we try to be reciprocal. We have clients looking for their services. We try to be reciprocal. It’s a big part of where we find clients to work with. Of course, there are exhibitions, such as the Money Show and also real estate exhibitions. We are working in Beijing with a pretty good media partner in the Beijing Media Group. We funded a small joint venture company with them for the northern China market, kind of mirroring what we’re trying to do in the southern and central areas.

Q. What are some of the best real estate “buys” in the U.S. today?

A. You can’t beat Manhattan overall, when you look at rental yields and when you look at how it’s been really restrained market over the last 10 years from a capital appreciation point of view despite everything that’s happened. Manhattan condominiums, for example, appreciated 60% between 2001 to 2010. We think that there’s still a lot of value there and a lot of stability there. If one of our clients says, “I want prime, I want stable, and I want safe,” we feel that Manhattan is very well aligned.

Some of our clients have more of a “want to see more rapid appreciation,” and we think that Miami, as long as you buy right, is well positioned from a 3-5 year viewpoint. The market saw some really substantial devaluation in properties, in some cases 50%+. Some very good developers (have) had some very prime properties that are selling for below construction cost.

Q. Would you say that for commercial property, too?

A. Primarily, residential is what we’re advising people about now. We think that there are some very good oceanfront condominiums in good buildings where the building itself is not in any financial danger and is 50-60% sold. We think there’s a good opportunity for Chinese buyers who want to buy those now and do a 3-5 year flip.

Q. What about other markets?

A. The suburban parts of L.A. still offer some very good value — places like Arcadia, Pasadena, Orange County, and Newport Beach. These areas are still 20% – and in some cases a little better than 20% — below their 2007 peaks. The market took a pretty substantial hit in 2007, but it rebounded quite quickly. Again, these are places that are well aligned with different clients we work with.

Q.

Jim Rogers said in an interview with Forbes recently that the agricultural sector holds a lot of promise for investors. Do you see much Chinese interest in U.S. agricultural land?

A. We do have two or three dairy farms in California that are on our website that are actively for sale, and we did bring a client to one. We have a client coming next month that has a fairly substantial dairy farming operation in China, not far from Wuxi, and it wouldn’t shock me if this group chose to transact on this dairy farm. The price of milk has gone way up proportionally to what this dairy farm is on the market for.

Q. Historically speaking, there isn’t a lot of connection between Florida and China. You’re working with developers there. Could you say more about how you pitch Florida’s potential to a Chinese investor?

A. The good part about Florida is that Chinese have heard of Disney and Orlando, but it’s amazing how little they’ve actually heard about Miami. And they don’t know how substantial it is. The state of Florida has engaged a PR firm in China to promote tourism and promote Florida as a destination, but it’s early. Could a university in a second-tier city in Florida attract Chinese students? I think the answer is yes, if they can integrate it with something. A partnership with a university in China would be a way that one could see flow thorough. Actually, in my home state of Michigan, is of course economically lagging in all kinds of ways. Three or four different universities have done an excellent job of attracting a really substantial number of Chinese students. That’s because they’ve made the effort and have done exceedingly well with it.